quicken tax planner problem

3 Part of the caveat from Quicken Windows to Quicken Mac is QM wont recognize certain investment transactions from QW. If you use TurboTax you can import your mileage from Quicken directly into TurboTax.

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

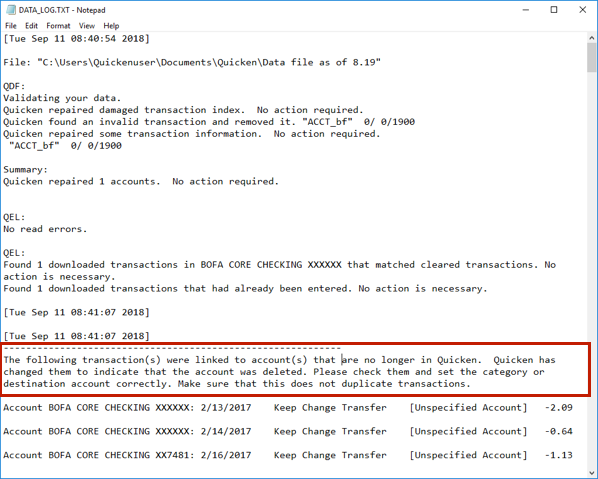

Overview If youre unable to open Quicken for Windows after a recent product update its possible that an issue during the installation is preventing Quicken from opening.

. Quickens robust financial planning tool includes several options such as budgeting tax planning and long-term planning. Ive used the Lifetime Planner feature and entered all of my long-term savings goals. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

Just as a point of fact Intuit the owners of Mint sold Quicken about five years ago to HIG Capital a hedge fund capital group. 1099-R- Used to report taxable and nontaxable retirement. The official name of the Quicken company is Quicken Inc.

To get the most accurate estimate of your taxes you might decide to fine-tune the values in the Tax Planner. In Product Enhancements Mac When will Quicken for Mac include a Tax and Planning module like Quicken for. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year.

Up to 5 cash back Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity. If youre not satisfied return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less. It is common for some problems to be reported throughout the day.

Sothats a no go. December 2021 edited January 13. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of.

Any tax planner data fields for which no quicken data is available are reset to zero. Ad A comprehensive financial planning tool to manage expenses investments more. Get 40 Off Quicken Today.

If you use that versions Tax Planner in 2022 Quicken displays your current. Updated the W4 tax rates and mileage rates in the Tax Planner. Tax and Planning Module.

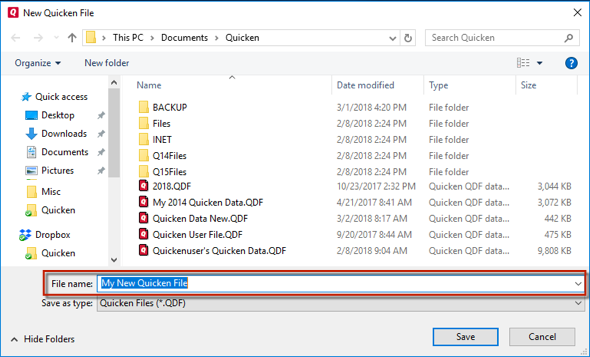

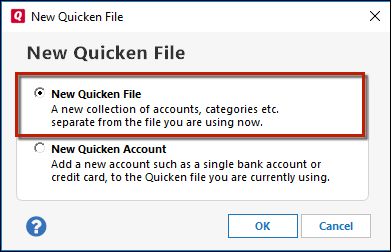

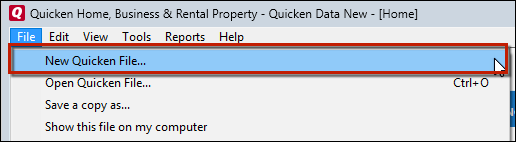

Downdetector only reports an incident when the number of problem reports is significantly higher than. I am currently unable to use the Quicken Tax Planner. In the File name field enter a name for the file and click Save.

The tax schedule line items Quicken uses include these forms and schedules. TurboTax Online no longer supports Quicken import. If you didnt do that its okay.

An issue where the new status blue icon of a transaction was not cleared after the transaction was edited. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. So Quicken Inc and thus Quicken.

For example the Subscription Release of Quicken is currently in 2022 so its Tax Planner supports calculations for tax years 2022 and 2021. But I do note that the Tax Schedule report and the Schedule E report will both indicate a problem when there is no Property tag assigned to any Schedule E. The results are different because each time Quicken includes or excludes different data from my file.

Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of the form seems to be. Quicken should review their release planning schedule and make changes to prioritize the allocation of resources for annually updating tax schedules that are posted by the IRS every year in late October or the first week of November. 2 You can convert from Quicken Windows with caveats to Quicken Mac but you cant convert any investment accounts from Quicken Mac to Quicken Windows.

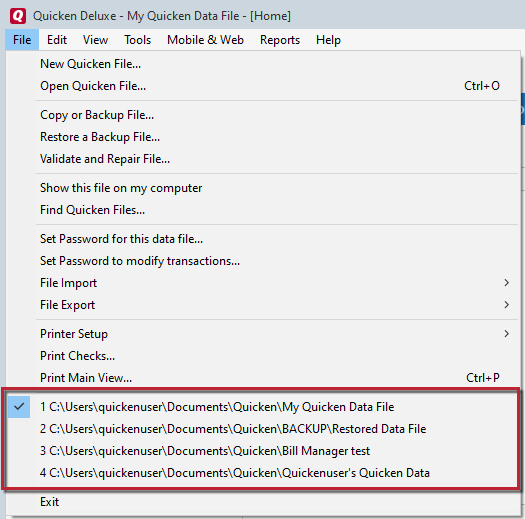

If youre able to open Quicken but youre not able to get into your file because of problems signing in with your Quicken ID you can find help for that by clicking here. Youll find it below the. Click the Planning tab and then click the Tax Center button.

1099-G - Used to report certain government payments from federal state or local governments. Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations. Overview If youre unable to open Quicken for Windows after a recent product update its possible that an issue during the installation is preventing Quicken from opening.

I can confirm the fix unbricked the Tax Planner and now shows data for 2020 2021 as it should. This chart shows a view of problem reports submitted in the past 24 hours compared to the typical volume of reports by time of day. You can manually enter projected amounts for information you choose not to track in Quicken remember to enter a full years worth.

Quicken outages reported in the last 24 hours. Without getting into the weeds on that I have normal goals like saving for a house saving for college etc. The current year and the year prior.

Choose Export Data To tax export file. Get the insights you need to manage your finances. These include but are not limited to BUYX SOLDX.

Business Tags affect Tax Planner Data. Click the Add Paycheck button. Now Quicken is telling me one large number I need to save monthly and predicting I will run out of money shortly after retirement.

Quicken can help you adjust your year-to-date totals using the Paycheck wizard. In the Save in field select a location for the file. Refer to the manufacturers instructions for your tax software for information about how to import the TXF file that was created.

30-day money back guarantee. Quicken billing. An issue where a subscription alert message could still display immediately after the subscription was renewed due to a timing problem with alerts.

Now it seems that opening and closing Quicken and then going to Tax Planner shows different results each time. Because the US. I dug into the budgeting tool with.

Steven Aubert Member. 1099-Misc- Used to report miscellaneous income received and direct sales of consumer goods for resale. In Budgeting and Planning Tools Windows Ive periodically had problems with Quickens Tax Planner.

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 Accounting Software Financial Information Business Support

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

401k Scheduled Deductions In Tax Planner Quicken

Quicken Unable To Verify Financial Institution Financial Institutions Financial Institution

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Pin On Quicken Helpline Number

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Phone Support Accounting Software

Blog Page 6 Of 19 Currace Quicken Words Containing Quickbooks

Pin By Intuit Quicken Support Usa On Quicken Support Supportive Free Advertising Accounting Help

Get Quicken Support Service Assistant Instantly Without Any Hassle Supportive Quicken Support Services

Quicken Update Fails Quicken Update Not Working How To Fix Quicken Errors Solution

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Pin By Erica Thomas On Sameer Managing Your Money Quicken Better One

Step By Step Solution For Quicken Error Cc 501 In 2020 Quicken How To Apply Error Code

Advanced Data File Troubleshooting To Correct Problems With Quicken For Windows

Get Quick Support By Quicken Professional Support Team Quicken Supportive This Or That Questions

How To Fix Quicken Error Code 1603 In 2020 Quicken Online Backup Coding